This gives you a better idea of the going rate for truck loans in the market. To get the most out of the truck finance calculator, compare loan options from multiple lenders.

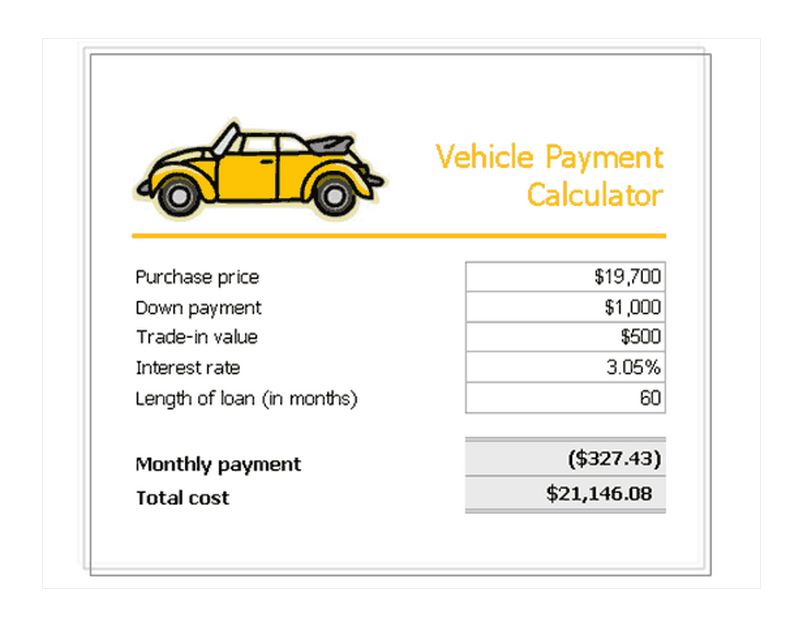

Your actual payment will depend on your agreement with the lender once your loan application has been approved.īefore you make any final decisions, factor in additional expenses such as insurance and maintenance costs when budgeting for your new truck. When using a truck loan calculator, keep in mind that the estimated payment may not be exact. You'll be able to see if changing loan terms or repayment frequencies can save you money on the lifetime of the loan. The truck loan repayment calculator gives you an idea of what your regular payments will look like so you can plan your finances accordingly. Plus, you can quickly narrow down your truck search to models that fit your budget. No need to compute everything yourself-simply input the information and you’re good to go. Why should you use a truck repayment calculator?Ī truck loan calculator helps you save time and money while helping you understand your truck finance options better. Learn how your regular repayments differ when you change repayment frequencies. Choose from weekly, fortnightly, or monthly on the calculator. The loan repayment frequency indicates how often you plan to pay off your loan. Borrowers choose to add a balloon payment to their loan to lower their regular loan repayments. You’ll pay it off as a lump sum after you’ve made all your repayments. Step 5: Add a balloon payment amountĪ balloon payment is an amount owed at the end of the loan term. Talk to one of our expert brokers to discuss the interest rates on your loan. The rate changes depending on market factors, your credit score, and the type of loan you’re getting. The interest rate is what you’re charged in addition to the principal loan amount. See how the loan term affects your regular repayments. The truck repayment calculator gives you three options for the loan term: 5 years, 4 years, or 3 years. The loan term is the length of time you’ll be making payments on the loan. You can always change the price later and get a new repayment estimate. If you’re unsure about the final purchase price, it’s best to put the higher-end price to be on the safe side. Put the purchase price of the truck you want to buy. Down payments aren’t essential for vehicle loans, but they could help lower your regular repayments. The loan amount is the total cost of the truck minus any down payment you plan to make. Follow these steps and get a truck loan repayment estimate instantly. Using a truck loan calculator is pretty straightforward. Use the results of the calculator to guide you when searching for the right truck loan. Take note, this calculator only provides a repayment estimate based on the information given. This truck finance calculator is great for comparing your loan options or as a frame of reference. You can approximate your loan repayments for different loan terms, varying repayment frequencies, and a range of interest rates. It calculates your repayments according to the loan amount, interest rate, and loan term you provide. Down Payment / Trade-In Value $ Total cash you will put down and the expected trade-in allowance on your current vehicle Sales Tax Rate % The total percentage rate of all state and local sales taxes that will apply to your purchase Interest Rate % The anticipated annual percentage rate (APR) on your truck loan Financing Period The total length of your loan term in months.A truck loan calculator is a simple online tool that computes your estimated loan repayments. Desired Monthly Payment $ The amount you would be willing and able to pay each month for your truck. See how much truck you can buy, based on the monthly payment amount you can comfortably afford.

#Semi truck loan payment calculator full

Truck Sales Price $ Full sales price, including title, license and other fees, but not sales tax Down Payment / Trade-In Value $ Total cash you will put down and the expected trade-in allowance on your current vehicle Sales Tax Rate % The total percentage rate of all state and local sales taxes that will apply to your purchase Interest Rate % The anticipated annual percentage rate (APR) on your truck loan Financing Period The total length of your loan term in months. To figure your approximate monthly payment, fill in the information below. Working within a budget is key to running a profitable business, so when you're in the market for a used truck, use our financing calculator to help you estimate how much truck you can afford and how much your monthly payment will be.

Owner Operator Fleet Financing Financing Calculator Insurance Financing Calculator

0 kommentar(er)

0 kommentar(er)